Download Tax Forms

Standard forms that are most commonly used for submissions to the Tax Office (KPP), especially if they are to be processed offline.

A PPnBM Exemption Certificate is a document stating that …

This request is submitted when the transfer or withdrawal …

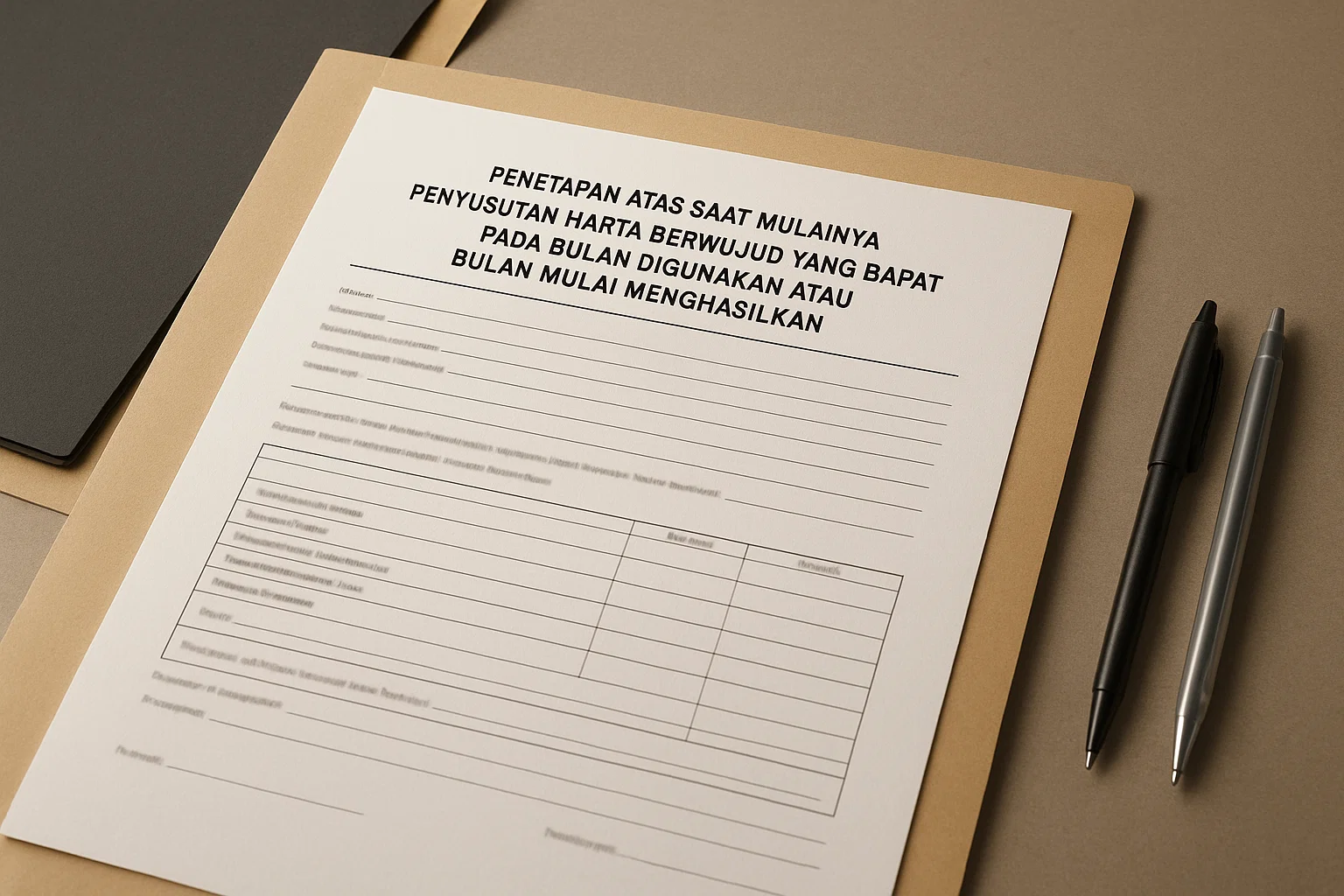

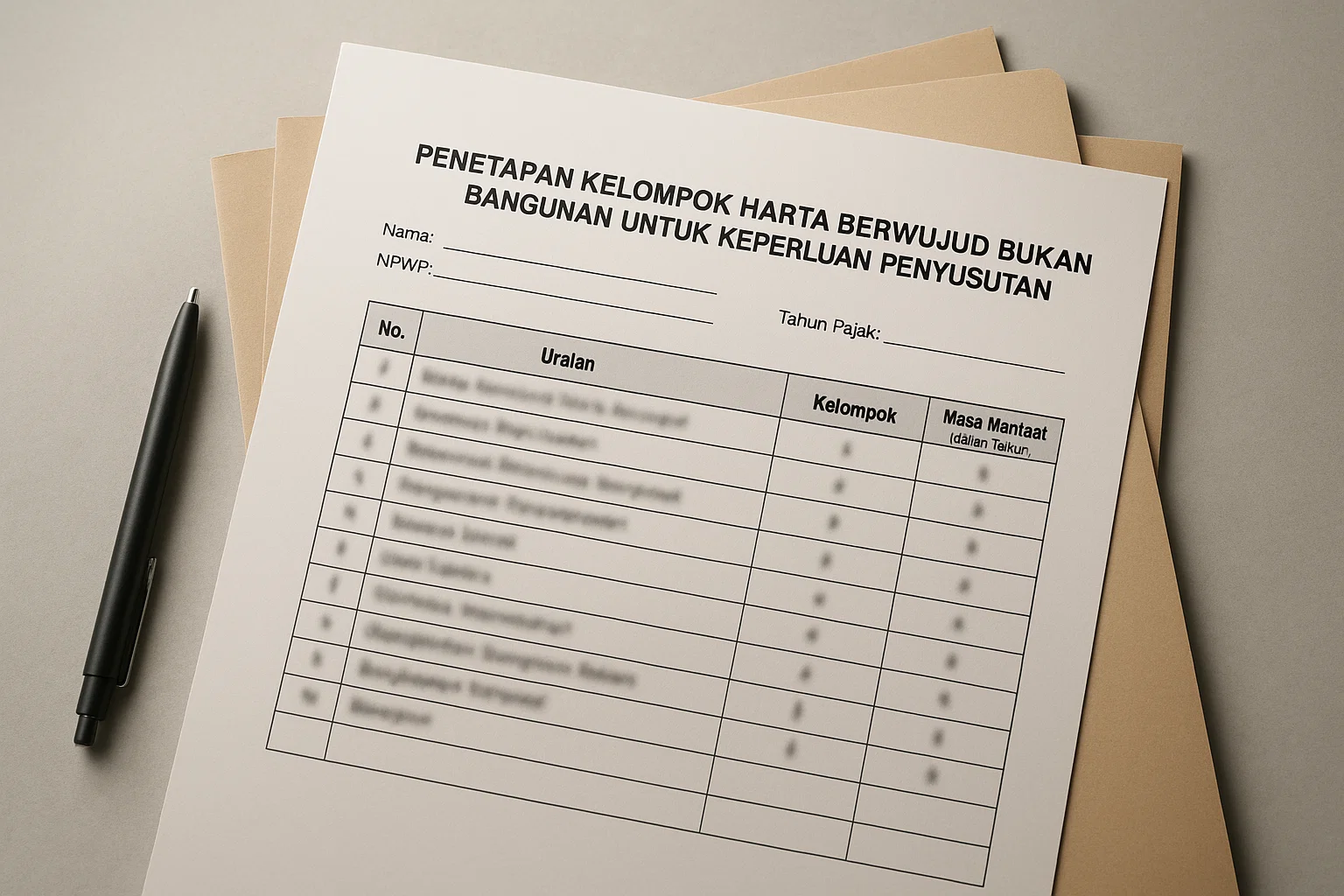

Depreciation of tangible assets begins in the month the …

This request is submitted when the Taxpayer does not …

This request is submitted when the Taxpayer does not …

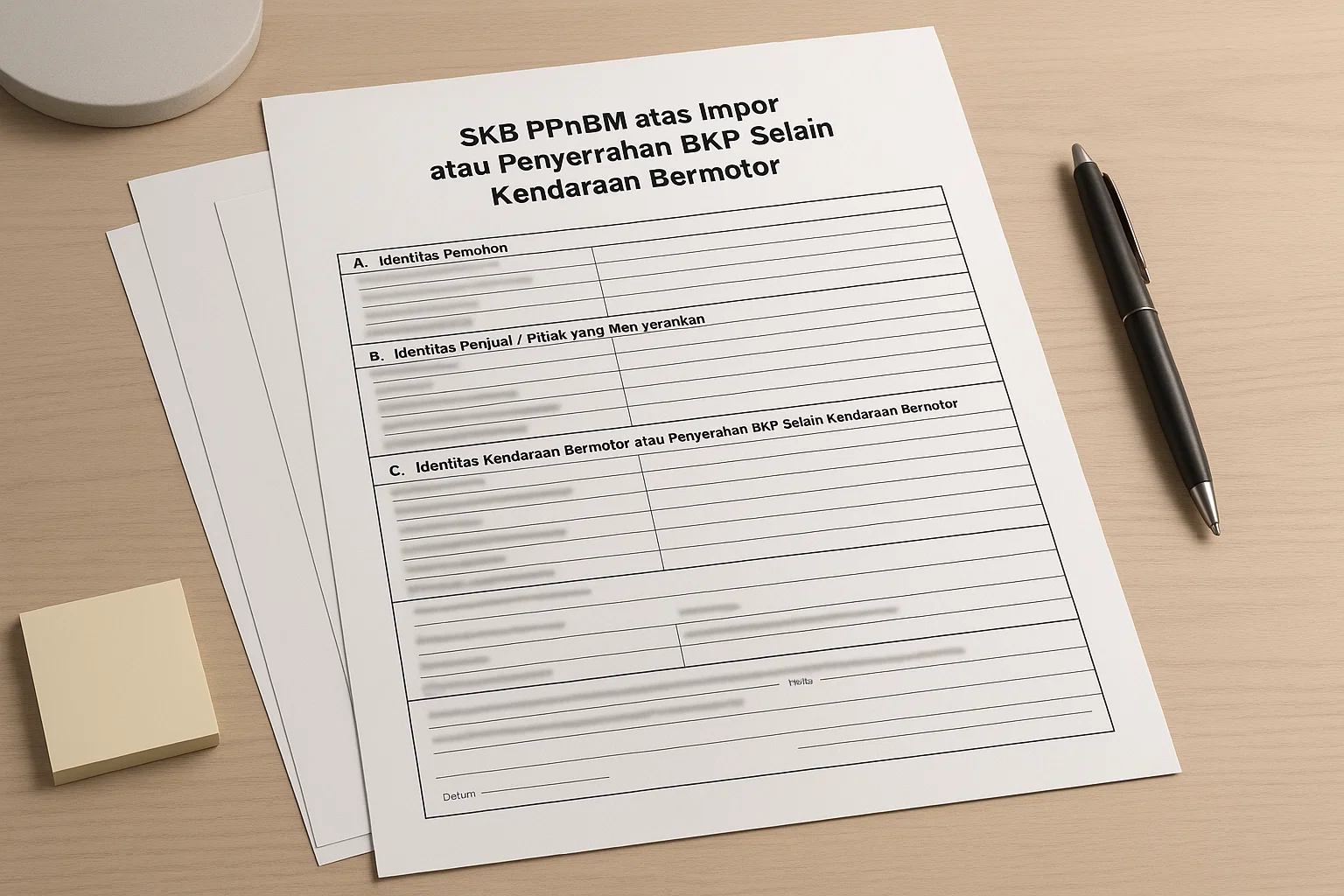

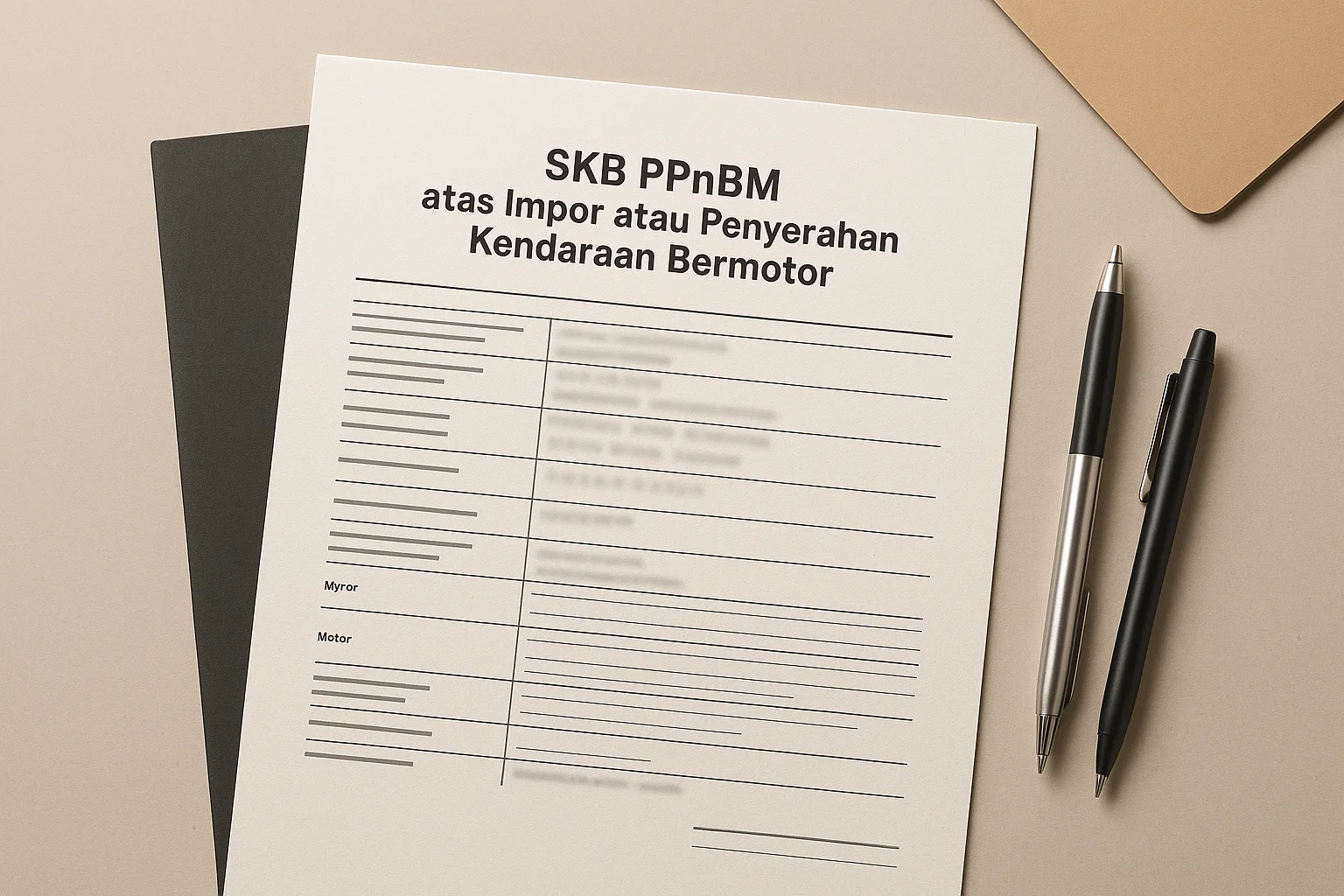

An administrative service for issuing a Luxury Goods Sales …

A service intended for foreign individuals (non-residents) who may …

This certificate states that the referred Taxpayer is an …

This exemption certificate is issued to Individual or Corporate …

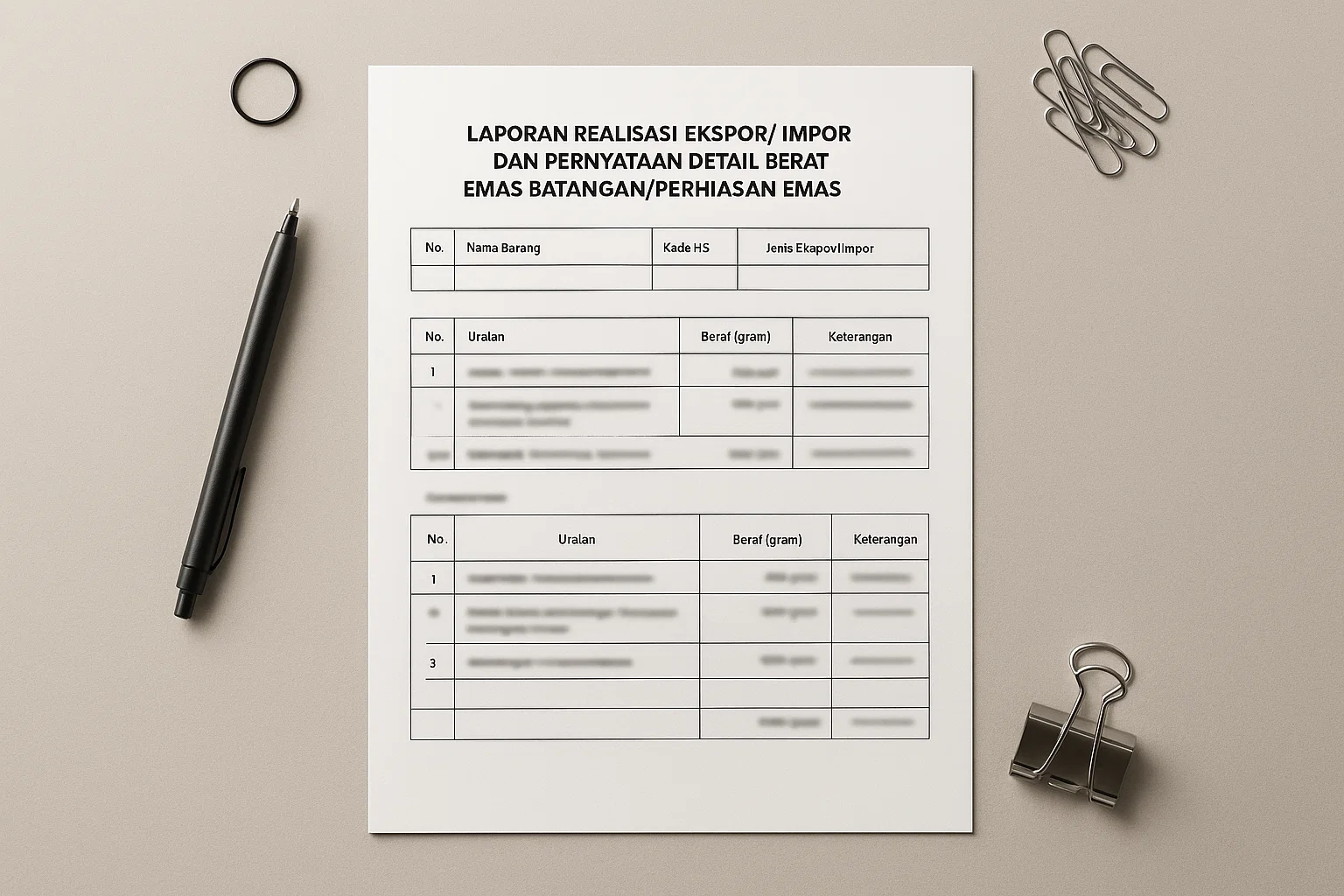

This report is an administrative service used to report …

This certificate is issued to Taxpayers who apply for …

Printed Stamp Duty refers to a stamp label applied …

Computerized Stamp Duty refers to a stamp label applied …

Imprinted Stamp Duty refers to a stamp label applied …

This notification is used to request a postponement of …

Taxpayers may maintain bookkeeping or records using the English …

This certificate states that the Taxpayer utilizes Taxable Services …

This certificate states that the referred Taxpayer is an …

A form used to notify the Directorate General of …

Notification Letter of Election to Be Subject to

This Certificate is used as proof that the Taxpayer …

This Letter serves as verification that the Taxpayer has …

This Letter serves as verification that the Taxpayer has …

Used to provide information regarding a Taxpayer’s compliance during …