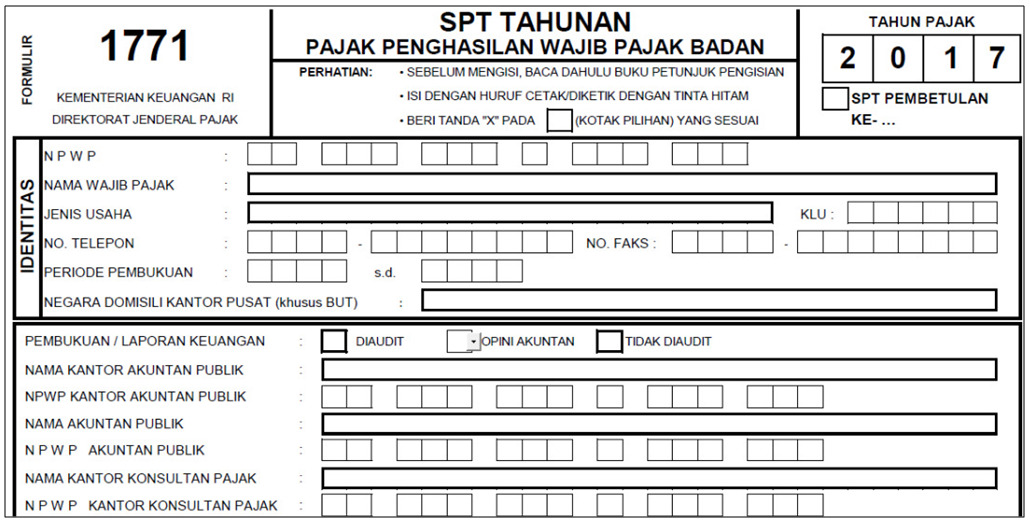

Annual Tax Return – Companies with Annual Revenue of Less Than IDR 2 Billion

- This service is valid for 1 (one) Tax Identification Number (NPWP) only.

- If the company has branches, the service fee will be adjusted based on the total revenue of the head office and all branches.

Service Features:

- Draft of Annual Corporate Income Tax Return (PPh Badan)

- Annual Income Tax Billing Code (applicable if the return is underpaid)

- Annual Corporate Income Tax Return Submission Service

- [FREE] Annual Income Tax Return Revision – 1 (one) time only, with corrections allowed up to 1 (one) month after the service is completed.

-

Profit and Loss Statement and Balance Sheet

- Financial statements are prepared as supporting documents/attachments required for the Annual Income Tax Return submission process.

- Financial statements are prepared based on transaction records, general ledger data, or other predetermined standard formats.

- [FREE] Online Consultation (Valued at IDR 549,000)

Consultation Terms:

- The online consultation is conducted in 1 (one) session with a total duration of 60 minutes.

- Consultation topics are related to the Annual Corporate Income Tax Return (PPh Badan).

- Online consultations are conducted via Zoom, Google Meet, Skype, or Google Duo.