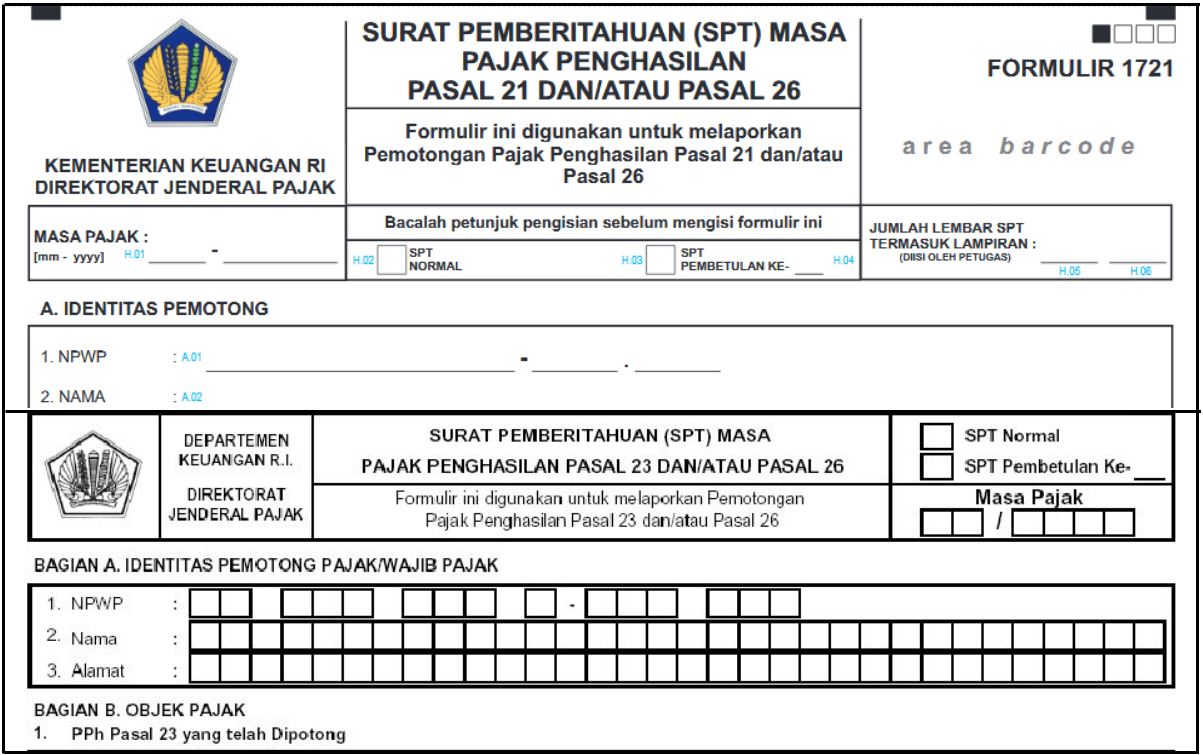

Monthly Income Tax Return – Companies with income less than IDR 200 million per month

Service Features:

- Income tax analysis based on transaction data provided

- Preparation of income tax returns

- Creation of deposit billing codes

- Submission of monthly Income Tax Returns to the Directorate General of Taxes upon client approval

- Delivery of electronic proof of tax return receipt

Income tax included:- Article 21

- Article 26

- Article 23

- Article 25 or Article 4 paragraph 2 / PP 55

Special Additional Features:

- FREE Consultation via Chat or Voice Note without time limit (unlimited) via WhatsApp group.

- FREE Consultation via Call, Zoom, and Google Meet for a maximum of 120 minutes per month with prior agreement with our Tax Expert.

- FREE Monthly Income Tax Return (SPT) Revision – 1 (one) time, with corrections made no later than 2 (two) weeks after completion of the work.

Other Terms:

- Tax Return services and consultations are only valid for one Taxpayer Identification Number (NPWP).

- The minimum purchase period for first-time services is three months. After that, services can be extended on a monthly basis.

- At the beginning of the service, our Customer Relations team will provide a detailed explanation in an online meeting.

- This service is limited to incomes below Rp 100 million per month, provided that total costs do not exceed the reported income.

- If the total cost exceeds the amount of income, there will be an additional service fee of IDR 100,000.